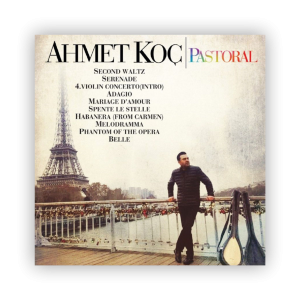

türkçe pop

₺618,75

₺644,53

₺539,06

türk sanat müziği

₺391,41

₺351,56

Plak

₺464,06

₺0,00

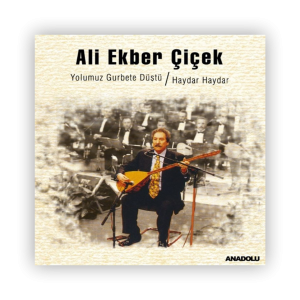

türk halk müziği

Plak

₺658,59

₺541,41

yabancı müzik

Plak

₺464,06

Plak

₺492,19

Plak

₺546,09

₺0,00

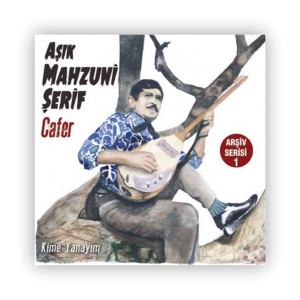

özgün müzik

Özgün Müzik

₺410,16

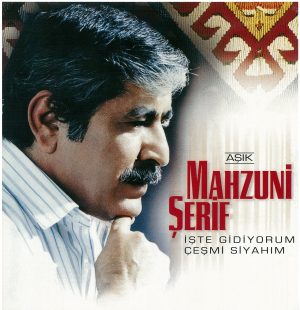

Özgün Müzik

₺464,06

Özgün Müzik

₺541,41

Özgün Müzik

₺679,69

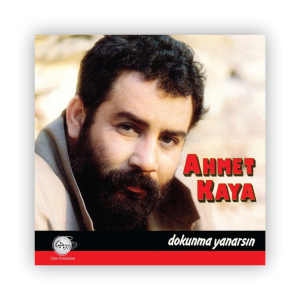

arabesk

Arabesk

₺539,06

Arabesk

₺515,63

₺351,56

Arabesk

₺541,41

PİKAPLAR

₺2.910,94

₺2.361,09

KEÇELER

Aksesuarlar

₺377,34

Aksesuarlar

₺377,34

Aksesuarlar

₺377,34

Aksesuarlar

₺377,34

aKSESUARLAR

Aksesuarlar

₺323,44

Aksesuarlar

₺323,44

Aksesuarlar

₺377,34

Aksesuarlar

₺377,34